Understanding Position Delta & Related Concepts

- Nov 30, 2021

- 7 min read

Options Greeks are used by options traders to assess the various risks that their positions are exposed to. There are various Greeks available that help traders in their analysis. Today we are going to discuss position delta. Options delta tells you how much that options price is expected to change relative to a change in the stock price whereas position Delta tells you the profits or losses you can expect relative to ₹1 changes in the underlying stock. By going through this blog, you will be understanding the position delta used in delta trading.

What is an Options Delta or Delta in finance?

In finance, delta is the rate of change price of an underlying asset with respect to the corresponding change in the price of its derivative. Delta is the expected change of an options price relative to one rupee movement in the underlying stock price. Underlying is just the stock that the option is traded against. Delta represents the expected change of an options price relative to price changes in the stock. Options delta represents the options directional risk. Delta is the main factor in deciding delta trading strategies.

What is CALL Option Delta?

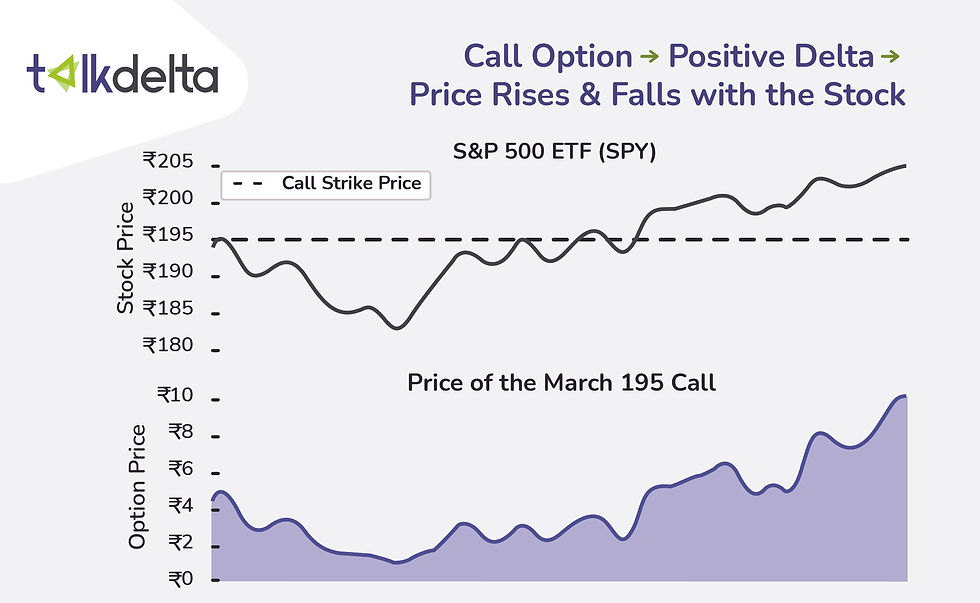

CALL options have a positive delta. A positive delta means that the price of a call option increases in value when the stock price rises and falls in value when the stock price decreases. In short, positive delta means that the options price moves with the stock price. Let's go through some examples to show you how Delta actually translates to expected option price changes relative to one rupee changes in the stock price.

Let's say that CALL has a delta of positive 0.75. The positive Delta indicates that the options price is expected to rise with the stock price and fall with the stock price.

If the stock price rises by 1 rupee, a delta of 0.75 indicates that, the 5 rupee option is expected to be worth (5.00 + 0.75) 5.75 rupees.

If the stock price decreases by 1 rupee, then the price of the 5 rupee option will become (5.00 - 0.75) 4.25 rupee.

See the graph below:

In this visual example, we can clearly see that when the stock price falls the CALL price falls, and when the stock price rises the CALL price also rises so this visual is just demonstrating to you that a CALL options positive Delta means that the CALL option rises and falls with the stock price.

What is PUT Option Delta?

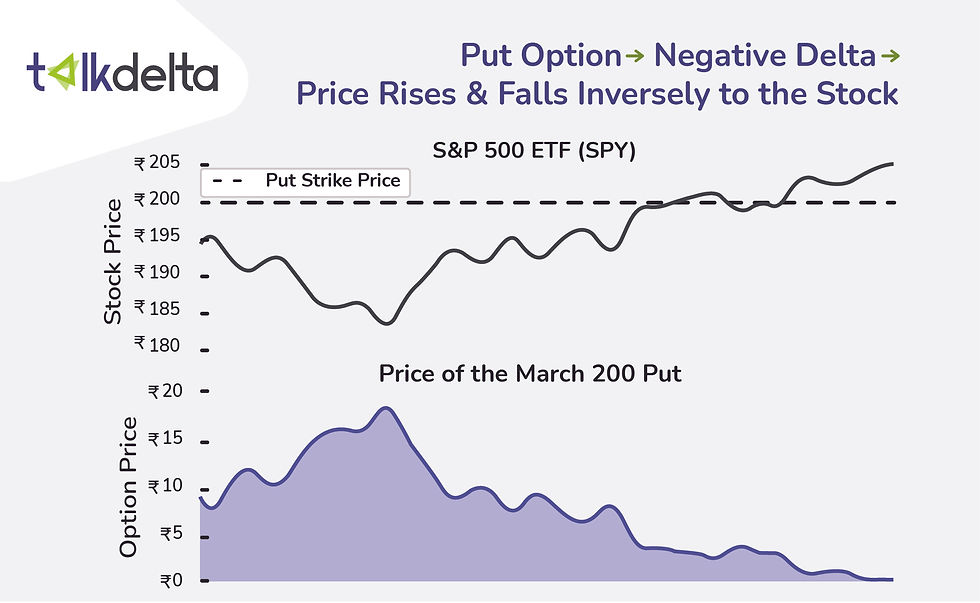

PUT options have a negative delta. A negative Delta indicates that the options price is expected to fall when the stock rises and the options price is expected to rise when the stock price falls.

For example, Assume that ₹3.00 PUT option has a delta of negative 0.25.

If the stock price rises by ₹1, that ₹3.00 option is expected to fall by 0.25 rupees and become 2.75 rupees.

If the stock price falls by ₹1, that ₹3.00 option is expected to increase in price by 0.25 rupee and become to 3.25 rupees.

See the graph below:

From the above visual example, you can get an idea about how the value of the PUT option changes with respect to the price of the stock.

Relationship between an options strike price and Delta

An option strike price can help explain its general Delta level. Let’s understand the value of delta for In The Money (ITM), At The Money (ATM), and Out of The Money (OTM) options.

ITM CALL will have a delta between +0.5 and +1

ITM PUT will have a delta between -0.5 and -1

ATM CALL will have a delta near +0.5

ATM PUT will have a delta near -0.5

OTM options are less sensitive. Therefore,

OTM CALL have Delta's between 0 and +0.5

OTM PUT have Delta's between 0 and -0.5

How to use Options Delta to gauge Directional Risk

Consider the two CALL options, the first CALL option has a price of ₹10 and its Delta is 0.95. So that means after a ₹1 share increase the ₹10 option is expected to rise by 0.95 and become 10.95. After ₹1 share decrease the ₹10 option is expected to fall by 0.95 and become 9.05.

Now let's look at the other option that is worth ₹1 and has a delta of 0.10. That ₹1 option is expected to increase by 0.10 when the share price rises by ₹1 and is expected to decrease by 0.10 when the share price falls by ₹1.

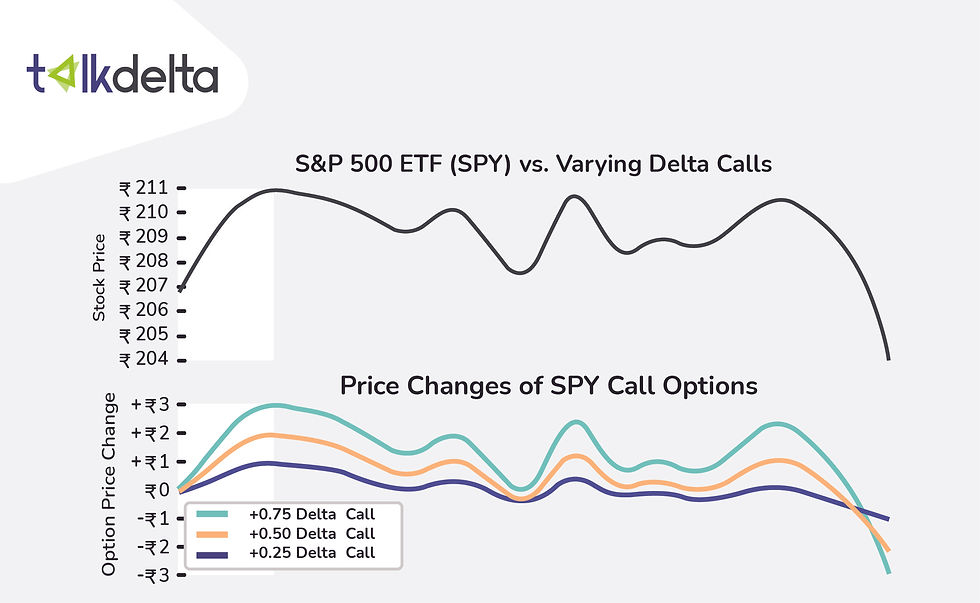

As we can see from the figure, the CALL option with the higher Delta is expected to fluctuate more in price when the stock price changes by the same amount. Therefore, options with larger Delta values are going to have more directional risk because the options price is expected to fluctuate more with each ₹1 change in the underlying. So let's build on what we just talked about by visualizing the price changes of three different CALL options with varying deltas.

See the figure below:

So, in this chart, we're looking at the S&P 500 ETF which has the ticker symbol SPY. Now in the bottom part of this chart, we're looking at three different SPY CALL options with varying initial deltas. So the Green Line is 0.75 Delta CALL, the yellow line is a 0.5 Delta CALL, and the blue line is 0.25 Delta CALL.

As we can see here it's very clear that the 0.75 Delta CALL is the most sensitive to changes in the stock price whereas the 0.25 Delta CALL is much less sensitive to those same changes in the stock price. So if we're talking about one single option contract, the closer the Delta is to 0 the less sensitive the option is to changes in the stock price. However, if we're looking at a CALL option, the closer the CALL of Delta is to +1 the closer that position is to risk.

If instead, you owned a PUT option with a delta of negative one the PUT options price is expected to increase by one rupee when the stock price decreases by one rupee.

See the figure below:

If you own a PUT option that increases by one rupee, the profit on that position will be plus ₹100. So all this means is that PUT options with delta closer to negative 1 acts like short stock positions and that their price changes will be 1 rupee for each ₹1 change in the stock price in the opposite direction. So if the stock price decreases by one rupee the PUT price will increase by one rupee and that is essentially the same thing as shorting.

Understanding Position Delta

Options delta tells you how much that options price is expected to change relative to a change in the stock price. You might need to know how much you're going to make or lose when the stock price changes. Position Delta tells you the profits or losses you can expect relative to ₹1 changes in the underlying stock.

What is position Delta?

Position Delta represents the expected profits or losses of an option position when the stock price changes more specifically when the stock price changes by one rupee. Consider one option position. Let's say we have a CALL option that is worth ₹10 and the CALL’s Delta is plus 0.75 and let's say you short two of those options contracts. Now based on the options Delta of positive 0.75 you know that the option's value is expected to increase by 0.75 for one rupee increase in the stock price and decrease by 0.75 for a one rupee decrease in the stock price. But that doesn't tell you how much money you're going to make or lose based on those stock prices. So to figure that out we have to look at position Delta.

Calculating Position Delta

To calculate position delta for standard equity options with a contract multiplier of 100 you can use the following formula:

Position Delta = Option delta x Number of Contracts traded x 100Here, 100 is the standard equity option contract multiplier. If you're trading options that have a non-standard multiplier such as 50 or 150 or 1000 then you would substitute that hundred for the contract multiplier that you're trading.

Let's look at some examples. Let's say we have a CALL option with a delta of 0.75 and we short two of those contracts. So our number of contracts is negative 2. Now our position delta based on the formula above is going to be negative 150 [Position delta= 0.75x (-2) = (-150)]. Now that means for a ₹1 increase in the stock price we're expected to lose 150 rupees and for a ₹1 decrease in the stock price we're expected to gain 150 rupees.

Now that's because we sold a positive Delta contract. When you sell something you want its price to decrease, when its price increases you lose money and since a CALL option increases in value when the stock price increases and we're expected to lose money when that CALL option increases. This way position Delta tells us how much we tend to gain or lose relative to movements in the stock price.

Two things to keep in mind if you're shorting contracts the first one is that the number of contracts traded is negative and the second thing is if you're not trading equity options with a standard multiplier of 100 you need to change 100 to the appropriate multiplier of the options that you're trading. For example, if you're trading S&P 500 futures options, the contract multiplier is 50.

To calculate the Delta of a complex options position just sum up the position Delta of each option.

Options Delta Trading Strategies with Position Delta

You can consider the following strategies for hedging according to the position delta.

When position delta is positive, hedge with these delta trading strategies:

Long Stock

Long CALLs

Short PUTs

Long CALL Spreads

Short PUT Spreads.

When position delta is negative, hedge with these delta trading strategies:

Short Stock

Long PUTs

Short CALLs

Short CALL Spreads

Long PUT Spreads

To know these strategies in detail you can refer to our Delta hedging strategies blog.

Conclusion

Delta- one of the options Greeks tells the expected change of an options price relative to one rupee movement in the underlying stock price whereas option delta helps you estimate the profit and loss you are going to face upon a change in stock price. Traders can make use of position delta to gauge the directional risks. The position delta can be calculated by multiplying the options delta with the number of options contracts multiplied by the option contract multiplier. According to the value of position delta i.e. either positive or negative you can choose the specific options trading strategy.

Hempdelics is one of the best dispensaries in the United States that sells legal Psychedelic Products ! Whether you’re looking for a great trip or you’re ready to dive deeper into unlocking your mind, Hempdelics got you covered. We are Best in psychedelic mushrooms and microdosing mushrooms!

<a href="https://hempdelics.com/product/oneup-bars/" rel="dofollow">OneUp Bars</a>

<a href="https://hempdelics.com/product/5-meo-dmt/" rel="dofollow">5-MeO-DMT</a>

<a href="https://hempdelics.com/product/buy-ayahuasca/" rel="dofollow">Buy Ayahuasca</a>

<a href="https://hempdelics.com/product/psilocybin-capsules/" rel="dofollow">Psilocybin Capsules</a>

<a href="https://hempdelics.com/product/lsd-gel-tabs/" rel="dofollow">LSD Gel Tabs</a>

<a href="https://hempdelics.com/product/liquid-lsd/" rel="dofollow">Liquid LSD</a>

<a href="https://hempdelics.com/product/lsd-blotters/" rel="dofollow">LSD Blotters</a>

<a href="https://hempdelics.com/product/mdma-pills/" rel="dofollow">MDMA Pills</a>

<a href="https://hempdelics.com/product/lsd-gummies/" rel="dofollow">LSD Gummies</a>

<a href="https://hempdelics.com/product/buy-golden-teacher-cubensis/" rel="dofollow">Buy Golden Teacher Cubensis</a>

<a href="https://hempdelics.com/product/magic-mushroom-grow-kits/" rel="dofollow">Magic Mushroom Grow Kits</a>

<a href="https://hempdelics.com/product/arenal-volcano-cubensis/" rel="dofollow">Arenal Volcano Cubensis</a>

<a href="https://hempdelics.com/product/blue-meanies-cubensis/" rel="dofollow">Blue Meanies Cubensis</a>

<a href="https://hempdelics.com/product/penis-envy-magic-mushroom/" rel="dofollow">Penis Envy Magic Mushroom</a>

<a href="https://hempdelics.com/product/amazonian-cubensis/" rel="dofollow">Amazonian Cubensis</a>

<a href="https://hempdelics.com/product/b-cubensis/" rel="dofollow">B+ Cubensis</a>

<a…